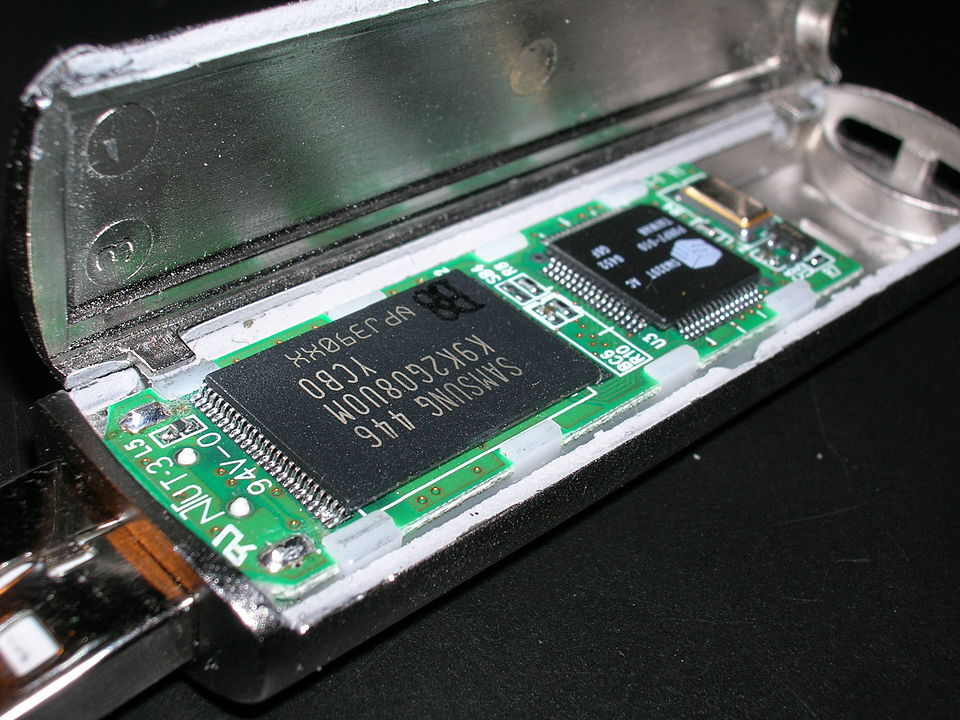

DigiTimes is highlighting concerns over a weakening of the NAND flash market, triggered by a reported decision by the world’s biggest DRAM and NAND maker, Samsung, to cut it SSD inventory – and even dropping this on the spot market.

This comes at a time when games console manufacturers like Nintendo are gobbling up internal NAND storage for their Switch thanks to increasing stay-at-home activities in the wake of the pandemic.

Industry insiders are concerned about possible future shortages, with OEM’s having to fight it out on the spot market. The spot market is highly competitive, offering both challenges and advantages. Any buyer or seller, including manufacturers, for example, OEMs (original equipment manufacturers), ODMs (original design manufacturers) and CMs (contract manufacturers), and distributors (for example, franchised distributors and non-franchised distributors) is free to participate in the spot market so as to regulate inventory caused by overstocking or shortages resulting from production limit.