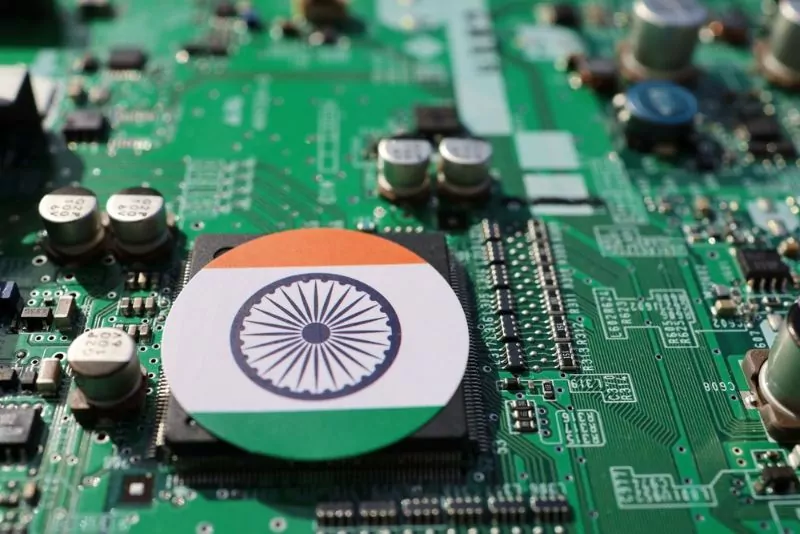

The US government is embarking on a historic intervention in the global semiconductor industry. The CHIPS and Science Act has already resulted in major funding for Intel and TSMC, and now Samsung is poised to receive up to $6.4 billion in subsidies to boost its US manufacturing footprint. This unprecedented financial commitment reflects both a desire to secure America’s position as a technological leader and growing geopolitical concerns about reliance on overseas suppliers.

Samsung’s decision underscores the critical role semiconductors play in modern economies. These tiny but powerful components underpin everything from consumer electronics to advanced military systems. The push for greater domestic chipmaking capacity highlights the potential vulnerability of existing supply chains, especially amid escalating tensions with China.

The semiconductor industry is welcoming the influx of government funding. The Semiconductor Industry Association (SIA) has emphasised the vital need to build a skilled domestic workforce to realise the full potential of the CHIPS initiative. With projections of tens of thousands of high-skilled jobs opening up in the coming years, the SIA is calling for a comprehensive education and training strategy to address talent shortages.

However, these developments have also sparked debate. Critics argue that massive government subsidies will ultimately distort global markets and could prop up companies that are less efficient than their international competitors. Others caution against the potential for a technology race driven by nationalistic ambitions, which could ultimately harm both innovation and global collaboration.

The long-term consequences of this massive intervention remain uncertain. The electronics industry, in particular, will need to navigate shifting sources of supply, potential price fluctuations, and increased scrutiny of its own global operations. Smaller semiconductor companies could also be squeezed out of the market if government funding focuses solely on a handful of giants.

Beyond the immediate economic impact, the US government’s actions send a powerful signal about the deepening intertwining of technology and national security. The semiconductor industry is seen as a key battleground for technological supremacy. How this plays out globally in the coming years will have profound implications for all sectors that rely on advanced electronics.

Overall, the US government is taking a bold gamble that massive subsidies will rebuild domestic manufacturing capacity and ensure its technology leadership for the future. Whether this strategy proves successful, and the broader costs and consequences, will be a defining issue for the electronics industry for years to come.

Thousands of senior engineers and procurement professionals subscribe to our LinkedIn Market Intel newsletter – get yours here

For more help with looking at supply chain options, contact Astute Electronics