Weakening memory demand may be a signal that the party is over in the semiconductor industry, reports EE Times.

According to the story, Micron Technology, the world’s third largest memory supplier, forecast a 17% drop in sales for the three months ending in August compared to the previous quarter.

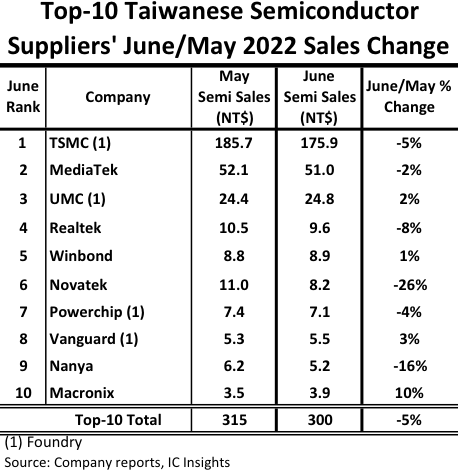

Research firm, IC Insights, agrees, “Early warning signs of a turning point in the semiconductor industry cycle are becoming more evident.” The top 10 Taiwanese semiconductor companies posted a 5% drop in June semiconductor sales as compared to May, with three of the four largest companies, including TSMC, registering a decline, reported IC Insights.

“While the vast majority of semiconductor suppliers only report their sales results on a quarterly basis, many of Taiwan’s semiconductor companies report their top line revenues on a monthly schedule with more financial details described in their quarterly reports. Oftentimes, these monthly results provide an early indicator of a possible change in direction in the semiconductor market, up or down.”

To avoid electronics supply-chain disruptions, you may also wish to consult an expert in electronics component supply. With more than three decades of supply-chain expertise, Astute Electronics is ideally placed to work with you on your daily component requirements.

For more help with looking at supply chain options, contact Astute Electronics