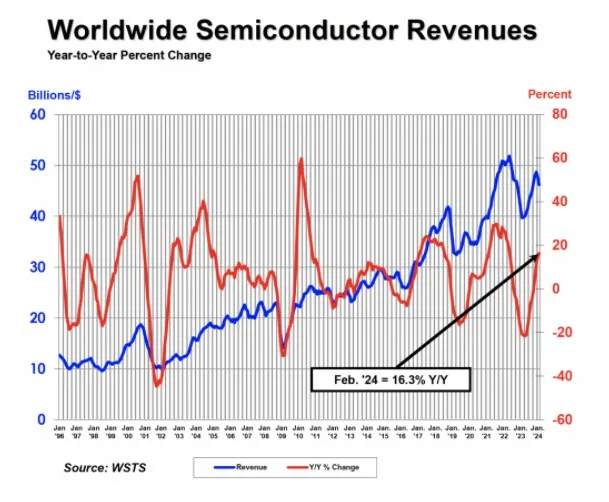

The global semiconductor industry continues its resurgence, with sales in February registering an impressive 16.3% year-over-year increase. This positive trajectory follows a temporary slowdown fueled by the unique post-pandemic economic landscape. Despite a slight month-on-month dip from January’s peak, the $46.2 billion in sales underscores the sector’s resilience.

China, the Americas, and the Asia Pacific region are leading the charge, while Europe experiences a more modest uptick. John Neuffer, SIA president and CEO, highlights this trend as “a continuation of the strong year-to-year growth the market has experienced since the middle of last year.”

The industry’s earlier stagnation, due to rising costs, supply-chain bottlenecks, and inflation-fighting interest rate hikes, has begun to dissipate. Easing inflation and the explosive growth of artificial intelligence (AI)– particularly generative AI – have injected renewed optimism into the market. Tech giants are aggressively pursuing AI’s transformative potential, further amplifying the critical role of semiconductors in the near future.

Analysts at Gartner project a robust 16.8% surge in global semiconductor revenues this year, reaching a staggering $624 billion. This bullish outlook presents compelling investment opportunities within the sector. Semiconductor heavyweights like NVIDIA, Lam Research, Applied Materials, Micron Technology, and ACM Research are poised to capitalize on this growth phase.

NVIDIA, a pioneer in visual computing and the inventor of the GPU, continues to expand its AI-centric solutions across various industries. Lam Research, Applied Materials, and Micron Technology provide the essential equipment and memory solutions underpinning the semiconductor fabrication process. ACM Research, with its focus on specialized cleaning technologies, is also riding a wave of success. According to Yahoo Finance, these companies boast strong earnings growth projections, making them attractive options for investors seeking to benefit from the chip sector’s revitalisation.

Thousands of senior engineers and procurement professionals subscribe to our LinkedIn Market Intel newsletter – get yours here

For more help with looking at supply chain options, contact Astute Electronics