In a significant shift in the memory market, industry titans Samsung and SK Hynix have announced their exit from DDR3 production, focusing instead on the burgeoning demand for high-bandwidth memory (HBM) and DDR5. This strategic move, confirmed by multiple sources including SemiMedia and Tom’s Hardware, reflects the rapidly evolving landscape of memory technology, driven by the insatiable appetite for AI-powered applications.

The decision to abandon DDR3, while surprising to some, is a calculated response to market forces. As reported by SemiMedia, “Samsung and SK Hynix are shifting their focus to high-bandwidth memory (HBM) and DDR5 memory.” The growing dominance of HBM and DDR5 in the server and PC markets, coupled with their higher profit margins, makes DDR3 a less attractive investment for these tech giants.

This shift has already started impacting the market, with DDR3 prices reportedly surging by up to 20%. This trend is expected to continue as production dwindles in the latter half of 2024, potentially benefiting smaller manufacturers like Winbond who still focus on DDR3.

The surge in demand for HBM, particularly HBM3, is a direct consequence of the AI boom. SK Hynix has reported that its HBM supply is completely sold out for 2024 and most of 2025, leading to price increases of 5-10% for all HBM types next year. Samsung, although not officially disclosing figures, is expected to face a similar situation.

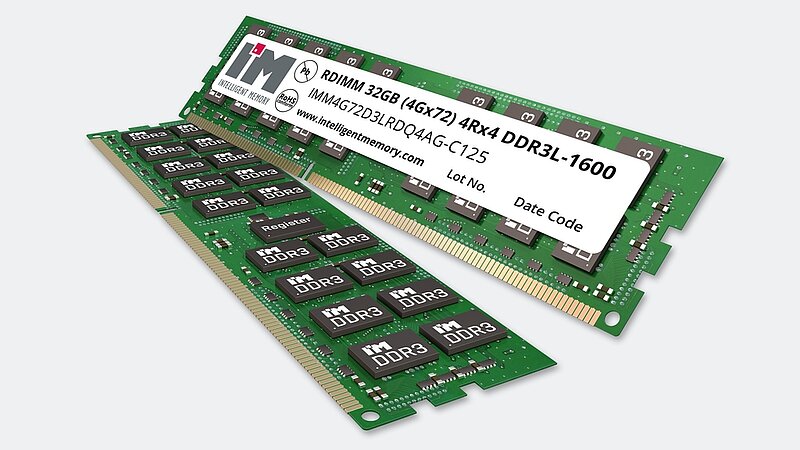

If you’re affected by the cut in DDR3, Astute Group can offer you long-term support for legacy memory through a range of manufactures like Intelligent Memory.

Simon Brennan, Astute Group, Technical BDM ‑ Memory & Embedded Solutions

According to the Korea Economic Daily, both Samsung and SK Hynix have already converted over 20% of their DRAM production lines to HBM, showcasing their commitment to this growing market. While this strategic move leaves a gap in the DDR3 market, it also demonstrates the agility and foresight of these companies in adapting to the evolving needs of the tech industry.

While Micron and Nanya will continue to produce limited quantities of DDR3, their output is unlikely to fully compensate for the loss of Samsung and SK Hynix. This could lead to a slow but steady increase in DDR3 prices, potentially creating a lucrative niche market for those willing to supply it.

This strategic shift by Samsung and SK Hynix underscores the rapid pace of technological change in the memory market. As AI continues to advance, the demand for high-performance memory solutions like HBM is only expected to grow, prompting further innovation and competition in this space.

Thousands of senior engineers and procurement professionals subscribe to our LinkedIn Market Intel newsletter – get yours here

For more help with looking at supply chain options, contact Astute Electronics