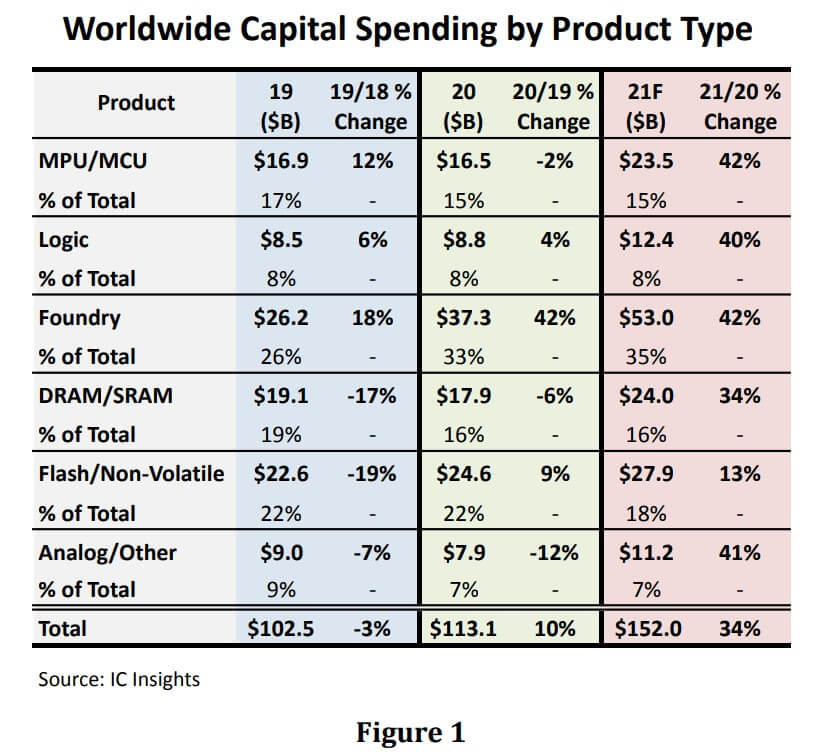

Worldwide semiconductor Capital Expenditure (CapEx) is on track to surge 34% in 2021, its strongest percentage gain since a 41% increase in 2017. The $152.0 billion in outlays this year would represent a new record high annual amount of spending, surpassing the previous high mark of $113.1 billion set just last year, reports IC Insights.

The foundry segment is forecast to represent 35% of all semiconductor capital spending in 2021, easily the largest portion of CapEx spending among the major product/segment categories. Spending by foundries has become very important (and necessary) as industry demand continues to rise for ICs fabricated using advanced process technology nodes.

TSMC, the world’s largest foundry, is forecast to account for a whopping 57% of the $53.0 billion in foundry spending this year. Samsung is also making significant investments in its foundry operations. Samsung has been able to match the technology roadmap of TSMC and continues its effort to lure more leading-edge fabless logic suppliers away from its pure-play foundry rival.

To avoid electronics supply-chain disruptions, you may also wish to consult an expert in electronics component supply. With more than three decades of supply-chain expertise, Astute Electronics is ideally placed to work with you on your daily component requirements.

For more help with looking at supply chain options, contact Astute Electronics here