Electronic component sales trends surged in February but cooled somewhat in March, according to the ECIA’s latest Electronic Component Sales Trend (ECST) survey. In February, survey participants had anticipated improving sales sentiment in March. However, the actual results for March show overall sentiment falling by 2 points down to 88.6. A number above 100 indicates growth.

Nevertheless, Dale Ford, ECIA’s Chief Analyst, noted that the overall index had improved by 32.6 points since November and had hit its best reading since July 2022. He further stated that the dip in March was minor in the context of the consistent improvement since the low of the index in November.

“Overall, the most recent electronic component sentiment measures indicate ongoing sales declines,” he added. “However, these results would still point to a soft landing in this current cycle.”

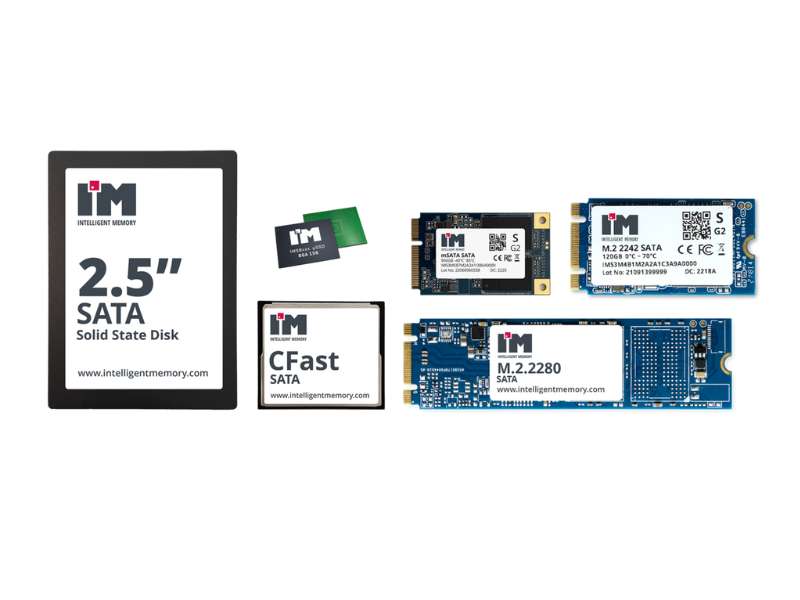

Semiconductors saw an increase from 82.9 to 86.3 in March, and the April outlook expects a score of 90.0. In contrast, the outlook for electro-mechanical has become increasingly pessimistic, with a projected April score of 86.7, which would be the lowest among the categories. The index results for passive components steer a middle course for the three categories as it dips by 2.1 points in March then rebounds in the April outlook to 90.5.

The end-market results in the March survey follow the same trend. Despite the chip shortage, the avionics/military/space, automotive, and industrial markets were able to maintain scores of 100+. According to Supplyframe, the automotive market’s optimism is being driven by electric vehicles, with Bloomberg reporting that by the end of 2022, fully electric vehicles will make up 7 percent of North American car production, a 1.3 percent rise from the year prior. The most optimistic news was the jump between 9.2 to 16.1 index points in the computer, consumer, and telecom mobile phone markets. Telecom networks, however, come in lowest among all markets with a score of 74.6.

To avoid electronics supply-chain disruptions, you may also wish to consult an expert in electronics component supply. With more than three decades of supply-chain expertise, Astute Electronics is ideally placed to work with you on your daily component requirements.

For more help with looking at supply chain options, contact Astute Electronics