The escalating crisis in the Red Sea has sent shockwaves through the container shipping industry, causing prices and disruptions across global trade routes. This presents a significant challenge for electronics manufacturers and buyers who rely on efficient and timely deliveries.

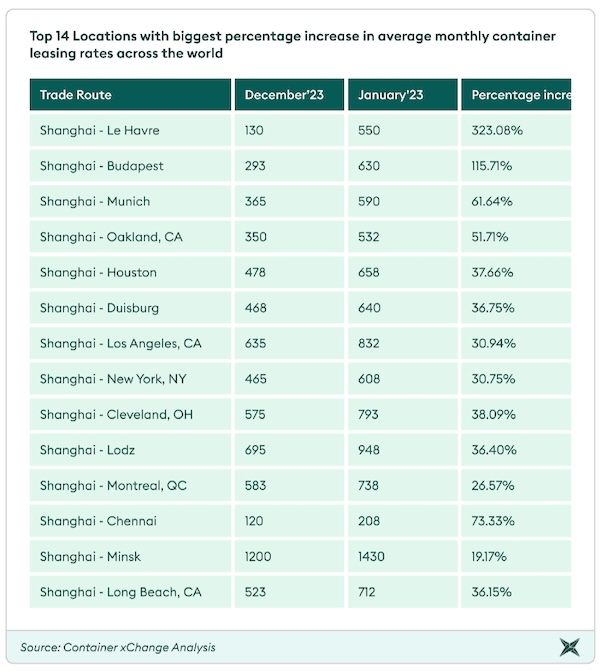

This graphic from Container xChange Analysis printed by Hellenic Shipping reveals how much costs are changing:

Prices skyrocket: Container prices, already recovering from pandemic lows, have spiked dramatically since the beginning of 2024. Key routes like China-Europe have seen rates double, with some leases approaching four times their previous value. This is primarily due to longer routes around Africa, equipment scarcity, and wider price gaps.

Global impact: While Europe faces the brunt of the increases, regions worldwide are feeling the effects. Ports in Asia and North America have also seen significant hikes, highlighting the interconnectedness of global trade.

Industries on edge: The disruptions threaten various industries, including electronics, automobiles, and pharmaceuticals. Delays in the supply chain could lead to production stoppages and impact global value chains. Experts urge businesses to adapt by holding higher inventory, anticipating longer transit times, and accepting higher container rates as the new normal.

Uncertainty looms: While January saw optimism about container prices stabilizing, the industry now expects them to remain exceptionally high due to the prolonged crisis. Businesses need to stay agile and vigilant in their planning to navigate this evolving landscape.

Key takeaways for the electronics industry:

- Expect higher container prices and longer lead times.

- Diversify sourcing options to mitigate risk.

- Increase collaboration within the industry for better forecasting and planning.

- Embrace agility and adapt to changing circumstances.

By staying informed and proactive, electronics businesses can weather this storm and ensure the continued flow of goods in a disrupted global market.

Thousands of senior engineers and procurement professionals subscribe to our LinkedIn Market Intel newsletter – get yours here

For more help with looking at supply chain options, contact Astute Electronics