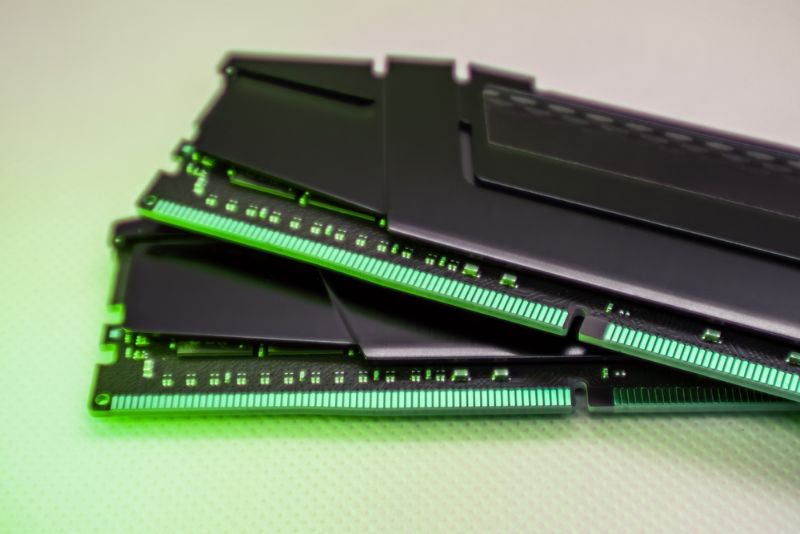

Artificial intelligence (AI) continues to revolutionise the tech industry, and its insatiable appetite for processing power is fueling a surge in memory demand, particularly for server DRAM.

Market research firm TrendForce predicts a 17.3% annual increase in server DRAM content per box in 2024, significantly outpacing other applications like smartphones and laptops. This explosive growth is attributed to the widespread adoption of advanced AI chips, requiring immense processing power and high-speed memory like DRAM.

“Training AI servers rely heavily on DRAM for their fast computing capabilities,” explains TrendForce analyst, highlighting the reason behind DRAM’s dominance in server memory growth. “Leading chipmakers like NVIDIA and AMD are driving this trend with their powerful AI-focused products.”

While smartphones also use AI technology, the lack of groundbreaking new functionalities in 2024 is expected to moderate the memory increase there. TrendForce forecasts a 14.1% and 9.3% rise in DRAM and NAND Flash content per smartphone, respectively, compared to 2023’s significant jump due to oversupply-driven price drops.

The notebook market presents a similar picture. The arrival of Microsoft’s AI PC specifications demanding high-performance CPUs will push DRAM capacity expansion in laptops, with TrendForce predicting a 12.4% annual growth rate. However, wider availability of these AI-powered notebooks is expected only in the latter half of 2024, limiting the immediate impact.

This trend highlights the crucial role of AI in shaping the future of memory demand. As AI applications continue to evolve and require more processing power, the demand for high-performance memory like server DRAM is likely to keep accelerating. This presents exciting opportunities for memory manufacturers and electronics companies catering to the AI revolution. However, navigating the complexities of component sourcing and fluctuating market dynamics will be critical for success in this rapidly changing landscape.

Thousands of senior engineers and procurement professionals subscribe to our LinkedIn Market Intel newsletter – get yours here

For more help with looking at supply chain options, contact Astute Electronics