The auto industry has adapted to a constrained supply, and as a result, is much less likely to be hit by significant disruption – that’s the view of Mark Fulthorpe, Executive Director, Global Light-vehicle Production, S&P Global Mobility.

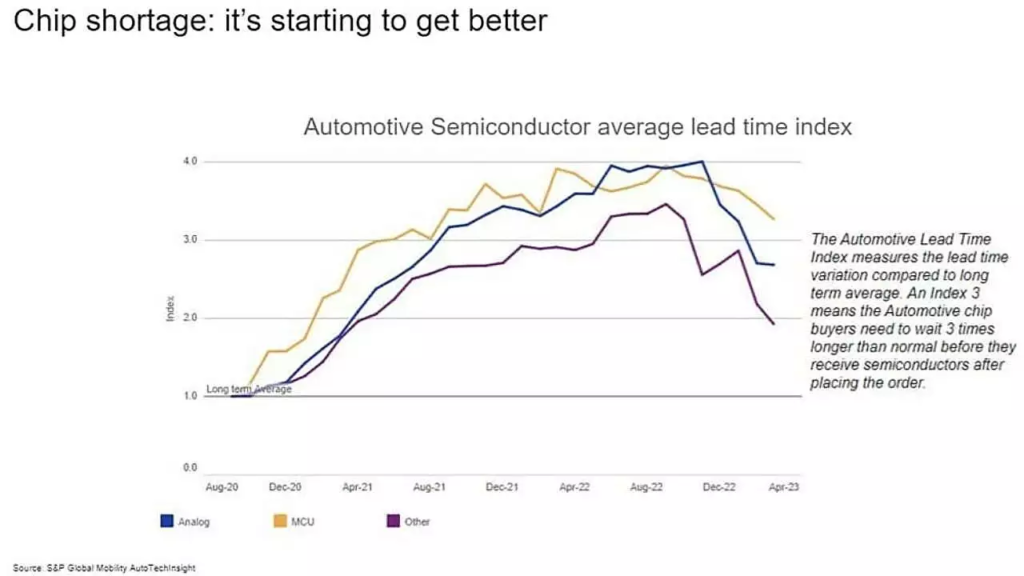

Although the semiconductor crisis is largely resolved, the chip supply situation still carries a degree of uncertainty, he notes. “Demand still exceeds the supply of several chip types. There is a shortage, even though the auto industry can better manage it today than two years ago.”

The use of semiconductors in autos continues to increase, indicating continued pressure. The industry demand for increasingly complex infotainment, advanced safety and vehicle autonomy systems will continue to escalate the usage of semiconductors in vehicles. According to Phil Amsrud, Senior Principal Analyst, S&P Global Mobility Supplier & Components Team, the value of semiconductors installed in vehicles averaged $ 500 per car in 2020 but is forecast to reach $ 1,400 per car by 2028.

Meanwhile, the structural lack of capacity for mature node capacity has not been addressed. Geopolitical trade risks remain as well, as evidenced by mainland China’s decision in early July to restrict exports of some key semiconductor materials. Trade tensions between the US and mainland China remain high, and future moves from either side can still affect the semiconductor supply.

Consolidation Of Electronics

Consolidation of electronics in cars is also driving the automotive semiconductor demand, with domain controllers and central computers replacing electronics control units (ECUs). This does not lessen the need for chips but rather means more — and more powerful — chips are needed.

The good news is that this consolidation enables the use of more advanced system-on-chip (SoC) and discrete memory, which are processed at more advanced process nodes. This is where most capacity investment is going. The bad news is that some analogue, discrete and power components will always be on mature process nodes, which receive much less investment. The movement to domain controllers and central computers may reduce the number of modules per vehicle and change the mix of semiconductors, but it will not reduce the overall number of semiconductors. Analog, discrete and power devices will get little if there is any benefit from moving to advanced process nodes.

There also is the question of how OEMs approach the manufacturing capacity equation following two years of lower volumes but — in some cases — stronger profits. Faced with lower capacity, largely due to the chip crisis, automakers could command higher pricing, heavily reducing reliance on incentives, and allocate chips to higher-margin products and trim levels within product lines.

For those automakers, there may be a rethink on managing the inventory versus demand and incentive to support the pricing power with managed production and to continue allocating chips to high-margin, high-feature set vehicles that inherently also require more chips. Going forward, the question may not simply be how many chips are available to the automotive industry but how different automakers allocate their supply.

To avoid electronics supply-chain disruptions, you may also wish to consult an expert in electronics component supply. With more than three decades of supply-chain expertise, Astute Electronics is ideally placed to work with you on your daily component requirements.

For more help with looking at supply chain options, contact Astute Electronics