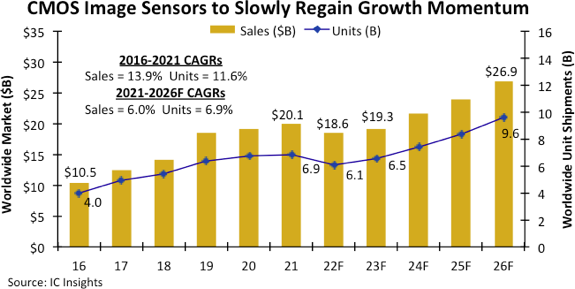

Global sales of CMOS image sensors are expected to decline for the first time in 13 years due to declining smartphone sales, slow growth in mobile phone cameras and a weakening global economy, reports IC Insights; but this may be only a temporary downturn.

Data show that for most of the past 20 years, CMOS image sensors have maintained strong growth and have become the largest product in the optoelectronic semiconductor market, accounting for 40% of the annual sales of the entire optoelectronic semiconductor market.

In addition to weak demand in mainstream consumer camera cellphones and portable computers, CMOS image sensors have been negatively impacted by deteriorating global economic conditions resulting from high inflation and spiking energy costs caused by the Russian war in Ukraine as well as U.S. trade bans on China, recent Covid-19 virus lockdowns in Chinese manufacturing centers, and slowing growth in the number of cameras being packed inside of new smartphones.

CMOS image sensor market leader Sony — which accounted for about 43% of CMOS image sensor sales worldwide in 2021 — believes excess inventories of phones and image sensors will be reduced by early 2023 and market conditions will “normalize” in the second half of its current fiscal year (ending next March).

A slow–but-steady recovery in CMOS image sensors is forecast by IC Insights, driven by a new upgrade buying cycle of smartphones and more embedded cameras being added in other systems, especially for automotive automation capabilities, medical applications, and intelligent security networks.

To avoid electronics supply-chain disruptions, you may also wish to consult an expert in electronics component supply. With more than three decades of supply-chain expertise, Astute Electronics is ideally placed to work with you on your daily component requirements.

For more help with looking at supply chain options, contact Astute Electronics