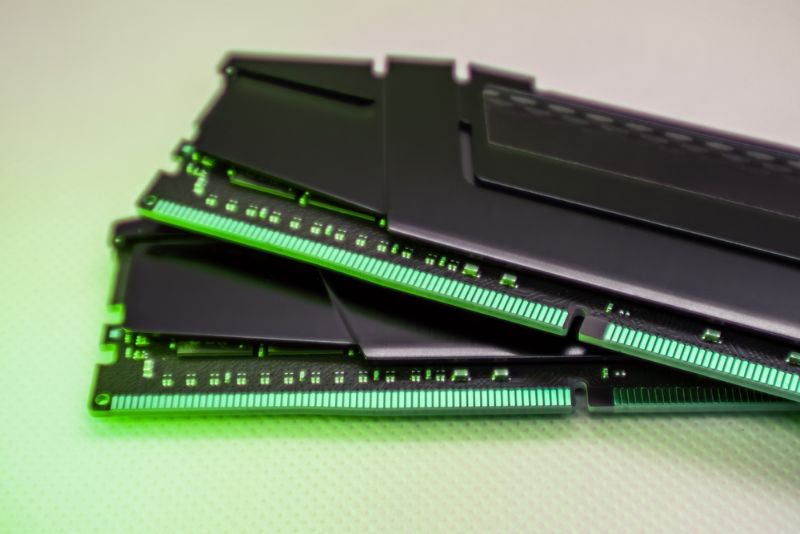

According to TrendForce research, despite the significance of peak season and rising DDR5 penetration, the 3Q22 DRAM market still succumbed to the negative impact of weak consumer electronics demand resulting from the Russian-Ukrainian war and high inflation, which in turn led to an increase in overall DRAM inventory.

This is the primary reason for a 3-8% drop in DRAM prices in 3Q22 and a more than 8% pricing dip in certain DRAM products for PCs and smartphones cannot be ruled out.

In terms of PC DRAM, sustained weakening of demand has led to PC OEMs adjusting their annual shipment targets and also caused DRAM inventories to soar rapidly. In 3Q22, PC OEMs remain focused on adjusting and destocking DRAM inventories, making a rebound in purchasing momentum unlikely. At the same time, since the overall DRAM industry remains oversupplied, even if PC demand is sluggish, suppliers still experienced difficulties in reducing their PC DRAM supply, resulting in a slight quarterly increase in the number of supplied bits. Therefore, PC DRAM pricing is forecast to drop by 3~8%

In terms of server DRAM, current client inventory levels of 7-8 weeks are slightly high, and through direct sales is currently the server field’s primary distribution channel, clients’ bit demand is still not enough to fully consume the bit output derived from increased wafer input and process advancement. In addition, demand for consumer PC DRAM and mobile DRAM is uncertain in 2H22, forcing suppliers to transfer production capacity to server DRAM. As a result, suppliers have to adopt certain sales strategies such as two quarter price binding or increasing on-hand inventory to suppress price declines. Server DRAM is forecast to drop by another 0~5% in 3Q22.

To avoid electronics supply-chain disruptions, you may also wish to consult an expert in electronics component supply. With more than three decades of supply-chain expertise, Astute Electronics is ideally placed to work with you on your daily component requirements.

For more help with looking at supply chain options, contact Astute Electronics