Electronic component prices are on the rise, with one chipmaker increasing prices between 5 percent and 40 percent in the past quarter, reports EPS News.

More tech companies mentioned “pricing” during their Q1 earnings calls than any other sector, including consumer goods, says GlobalData, who reported that discussions about pricing grew by more than 65 percent compared with the same quarter last year.

“That shouldn’t come as any surprise. Chip prices have increased as they have remained scarce. The cost of moving chips around the world – whether by air, land or sea – has also spiked,” says EPS writers. “For the most part, U.S. manufacturing companies have been able to pass those increases on to customers, according to the Institute for Supply Management. But sectors differ, and high-tech often tries to absorb logistics costs as part of their service offerings.”

Across the board, component makers cited supply chain volatility as the main reason for the price hikes. Many tried to avoid raising prices by increasing efficiency, but most are investing to increase capacity. Silicon Labs noted unprecedented cost increases throughout its supply chain — raw materials, foundries test and assembly, logistics and labour.

The same pressures are extending lead times at unprecedented levels. Chip supplier Infineon’s lead times increased from an average of 48 weeks to 60 weeks. IP&E vendor Vishay Intertechnology’s lead times extend beyond one year, Fusion reported.

Across the board, component makers cited supply chain volatility as the main reason for the price hikes. Many tried to avoid raising prices by increasing efficiency, but most are investing to increase capacity. Silicon Labs noted unprecedented cost increases throughout its supply chain — raw materials, foundries test and assembly, logistics and labor.

The same pressures are extending lead times at unprecedented levels. Chip supplier Infineon’s lead times increased from an average of 48 weeks to 60 weeks. IP&E vendor Vishay Intertechnology’s lead times extend beyond one year, Fusion reported.

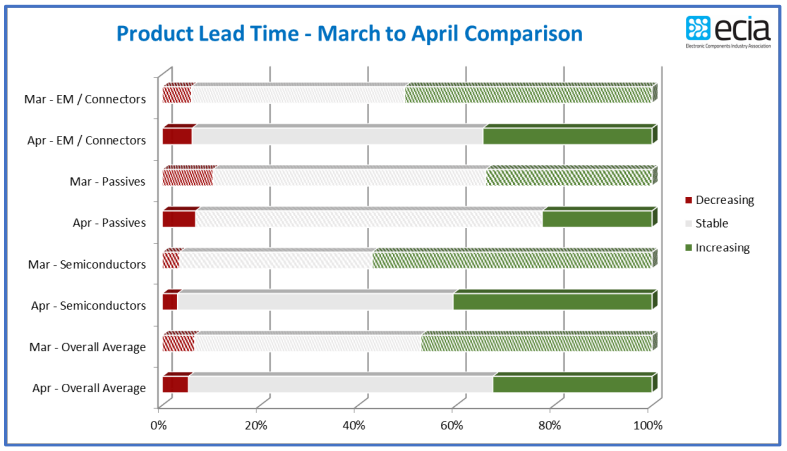

However, the ECIA’s latest ECST survey results point to possible lead time relief after actual reported lead times jumped back up again in March. The April ECST survey reports a substantial decline in expectations for increasing lead times between March and April.

Passive components show the greatest optimism for less pressure on lead times while Semiconductors report the greatest pressure. However, all three component categories show major improvement in expectations. This is a return to the more hopeful lead time sentiment seen in recent surveys.

To avoid electronics supply-chain disruptions, you may also wish to consult an expert in electronics component supply. With more than three decades of supply-chain expertise, Astute Electronics is ideally placed to work with you on your daily component requirements.

For more help with looking at supply chain options, contact Astute Electronics