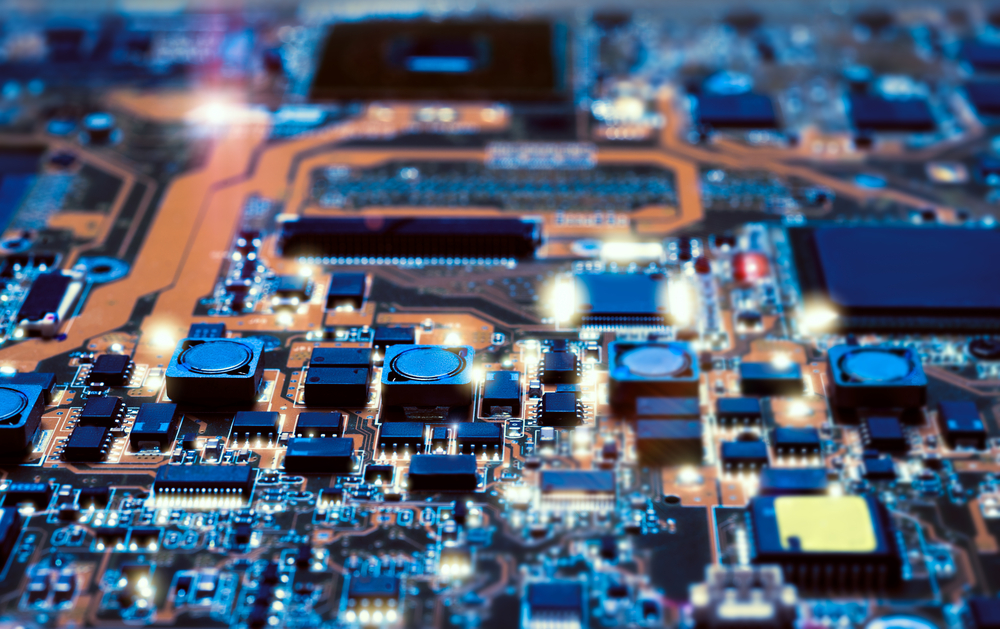

A new report by GlobalData, a leading data and analytics company, claims there’s been a 50% cut in semiconductor operating capacity in the space of three months.

At the same time, the global supply chain has stalled, exacerbated by COVID-19-related border checks that could last for months.

David Bicknell, principal analyst at GlobalData, says, “The COVID-19 pandemic will shrink worldwide end-user demand for everyday products powered by semiconductors,” he said in an article published in Electronics Products and Technology.

On the supply side, the manufacturing operations of China-based dynamic random access memory (DRAM) and flash memory plants have been largely unaffected, as highly automated semiconductor fabrication plants need little manpower, reports the article.

“The captive semiconductor operations of Apple, Huawei, Google, Amazon, and Alibaba, remains long-term, up to five years ahead, and designers can use cloud-based services,” Bicknell concludes. “By then, China’s currently weak semiconductor industry will have grown to become a challenging competitor for the US.”